“RBI MPC Meeting: RBI repo rate 5.5% to Balance Growth and Inflation.”

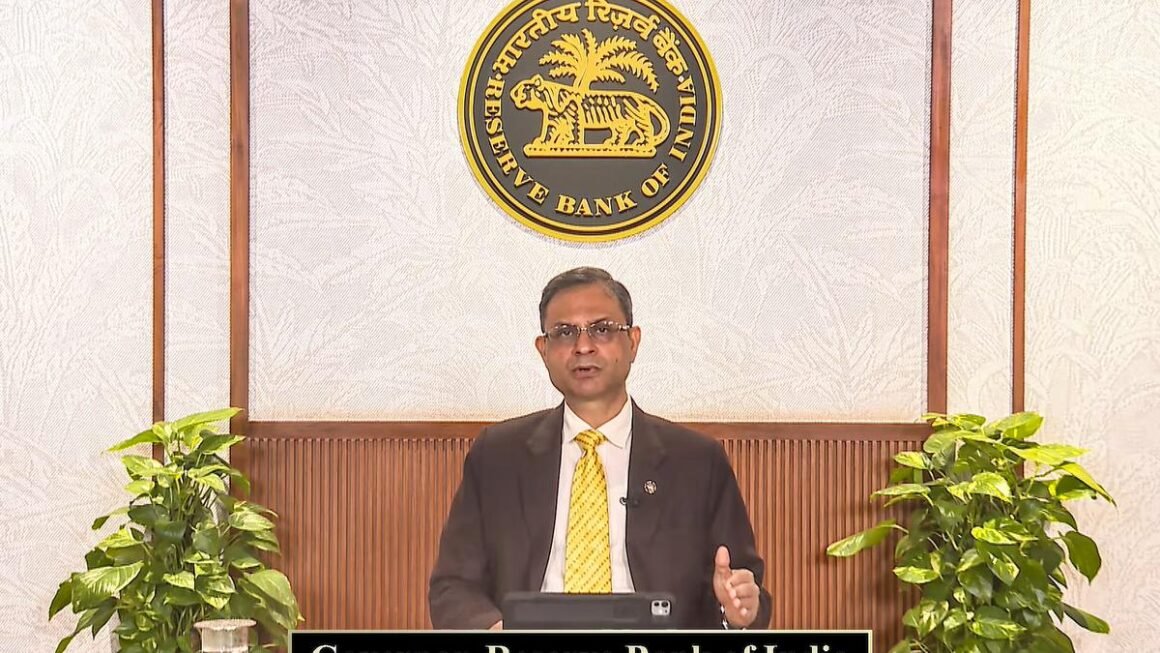

India’s economic landscape remains under close watch as the Reserve Bank of India (RBI) convenes its Monetary Policy Committee (MPC) meeting. Today, in a decision that impacts millions of borrowers, investors, and businesses across the nation, Governor Sanjay Malhotra announced that the repo rate will remain unchanged at 5.5%. This carefully considered move reflects RBI’s strategy to balance steady economic growth with inflation control amid fluctuating global markets.

The decision is significant as it comes at a time when India is navigating a mix of strong domestic demand, global commodity price fluctuations, and geopolitical uncertainties. The RBI MPC Meeting aims to maintain stability and predictability for the economy while ensuring that monetary policy adapts to the evolving challenges and opportunities facing India.

the RBI MPC Meeting:

- Repo Rate: Maintained at 5.5%, signaling RBI’s balance between curbing inflation and supporting economic growth.

- Inflation Outlook: Governor Malhotra acknowledged rising global commodity prices but stated that domestic inflation remains within the target range.

- Growth Forecast: RBI has revised India’s GDP growth forecast slightly upward, citing stronger domestic demand and recovery in manufacturing.

- Liquidity Conditions: The central bank will continue to maintain an accommodative liquidity stance to support economic growth.

- Global Concerns: RBI noted uncertainties due to geopolitical tensions and global interest rate movements impacting India’s external sector.

Governor Malhotra emphasized that the decision to keep rates steady is aimed at fostering stability and predictability for businesses and consumers. He added that the RBI will monitor inflation and growth data closely and is prepared to adjust policy measures if necessary.

Market Reactions: RBI MPC Meeting

Following the announcement, Indian stock markets showed a mixed reaction, with benchmark indices experiencing modest fluctuations. The bond market remained stable, while the rupee showed slight strengthening against the US dollar.

What This Means for You:

- Borrowers: Home loan and personal loan EMIs will remain steady, offering predictability in repayments.

- Investors: The stable rate environment may keep equities attractive, though global factors should be monitored.

- Consumers: Inflation control remains a priority, ensuring that everyday costs remain manageable.

The decision by the Reserve Bank of India to keep the repo rate unchanged at 5.5% reflects a strategic effort to balance inflation control with sustained economic growth. Governor Sanjay Malhotra’s approach underscores RBI’s commitment to maintaining stability amid global uncertainties and domestic economic shifts. For borrowers, this offers predictable loan repayments; for investors, a stable rate environment; and for consumers, continued inflation control. As RBI continues to monitor economic indicators, future monetary policy adjustments will remain aligned with India’s growth trajectory and price stability objectives, ensuring resilience in the face of evolving global and domestic challenges.

FOR MORE BLOGS – beyondthepunchlines.com

Add to favorites

Add to favorites