The International Monetary Fund shaped the global financial order of the 20th century, but the BRICS New Development Bank is emerging as a defining force in the 21st century.

Why India Cannot Afford to Ignore the BRICS Bank’s Growing Power

India is not just a spectator in this global financial power shift — it is a frontline player. As the world questions the IMF’s dominance, India is already cashing in on the rise of the BRICS Bank. From the Mumbai Metro funding to loans for renewable energy expansion, New Delhi has turned the NDB into a new source of strength.

For India, the impact is direct. The NDB offers loans without IMF-style austerity, gives New Delhi bargaining power in global negotiations, and even pushes the rupee into the global trade system. For a country aiming to be a global economic powerhouse, the BRICS Bank is more than just another lender — it is India’s ticket to greater sovereignty in finance.

A Summit That Shook the West: What Happened in Rio and Why It Matters

In July 2025, the world took close notice as Rio de Janeiro hosted the BRICS Summit that saw the 10th anniversary of the New Development Bank (NDB). There were many reasons why the summit made the headlines: Indonesia was welcomed as a new member, Colombia affirmed a $512 million purchase of shares, and the bank announced a new guarantee fund to reduce the cost of financing for developing countries. But things did not end there — Donald Trump vowed to impose a 10% tariff on BRICS-aligned countries, and the absence of both Xi Jinping and Vladimir Putin revealed fissures within the bloc.

Still, governments across the Global South hailed the move. India’s Finance Minister Nirmala Sitharaman remarked that “the NDB is not just an institution, but an instrument of fairness in global finance, giving countries the right to choose development without conditions.” South Africa’s President Cyril Ramaphosa called it a “turning point for sovereignty in Africa,” and Brazil’s Luiz Inácio Lula da Silva said, “For too long, the IMF dictated; now the Global South is speaking back.”

Eighty Years of IMF Control: Why Nations Are Now Rebelling Against Old Rules

For nearly 80 years, the International Monetary Fund (IMF) has had its way with nations’ financial destinies. Established in 1944 at Bretton Woods, it granted unprecedented financial power to the U.S. and its allies. With over 16% American voting strength, Washington had de facto veto over key IMF choices.

As the IMF stabilized economies, its loans were often followed by agonizing conditions. Argentina reduced subsidies at the IMF’s urging, sparking massive protests. Greece suffered brutal pension and wage reductions throughout the Eurozone crisis. In Asia, in the 1997 financial meltdown, economies there were forced to privatize and deregulate, moves that repeatedly exacerbated inequality. Critics say these measures created short-term bailouts but fueled long-term dependence.

The Birth of a Counterweight: How BRICS Created a Bank to Break the Monopoly

In 2014, the Brazil, Russia, India, China, and South Africa began the New Development Bank (NDB) to compete with the IMF and World Bank. It began with a capital of $100 billion and was intended to lend without Western vetoes, without IMF austerity, and above all, without reliance on the U.S. dollar.By 2025, the NDB had financed over $33 billion worth of 96 projects. In India, $260 million went to the Mumbai Metro Line, enhancing urban transport. NDB lending was used by Brazil to build wind and solar farms worth nearly $300 million, while South Africa got water and sanitation projects to build up supply for millions of citizens.

Russian officials argued that sanctions had proven the need for “a financing system independent of Western choke points.” China’s Commerce Ministry emphasized that the NDB would “complement, not destroy, global institutions,” though the West remained skeptical of Beijing’s growing role.

From Shanghai to the Global South: Where the NDB Is Expanding and How It Operates

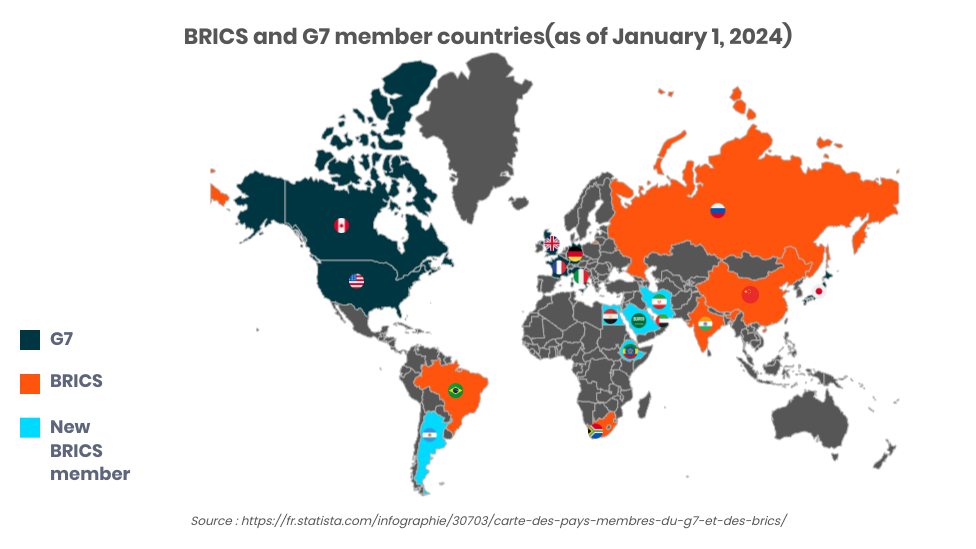

Headquartered in Shanghai with regional offices in South Africa and Brazil, the NDB is expanding its global presence. The UAE, Egypt, Iran, Uzbekistan, Indonesia, and Colombia are some of the new countries included in the NDB membership. Around 25% of the NDB loans are presently denominated in local currencies, a figure that will increase to 30% by 2026, breaking the chains of dollars and enhancing the financial sovereignty of the borrowing countries.

Most significantly, 40% of its capital is devoted to green and sustainable projects, from solar farms to advanced energy grids and climate resilience. At the Rio summit, NDB-backed loans will drive South America’s infrastructure drive, Brazil’s finance ministry said, while Egypt’s government promised the bank’s expansion “will unlock resources beyond IMF austerity.”

Power Shift or Pipe Dream? The Revolution That Worries the West

The IMF still holds a $1 trillion lending capacity, but BRICS nations counter with 40% of the world’s population, 30% of global GDP, and 50% of energy reserves. That kind of structural power is not easily dismissed.

Even so, U.S. Treasury officials warned that the NDB risks “fragmenting global finance” and could undermine stability if it sidelines dollar-backed systems. European Union leaders echoed this, insisting that IMF reforms were preferable to building “parallel structures.” Analysts also point out that China’s dominance could turn the NDB into a tool of Beijing’s influence, that Russia’s sanctions restrict its capital market access, and that South Africa and Brazil’s economic slowdowns may weaken contributions.

Still, leaders across Asia, Africa, and Latin America argue that the NDB represents something more powerful than just another bank — it represents freedom of choice in a world where IMF bailouts have often come with political costs.

India’s Balancing Act: How New Delhi Uses BRICS Without Burning Bridges with the West

For India, the NDB is an opportunity and strategy. As a founder member, it has secured funding for metro, highway, and clean energy projects without IMF-type strings attached. Simultaneously, India keeps within its reach the IMF and World Bank institutions, balancing Western allegiances with BRICS fraternity.

This singular position — both reformist voice within the IMF and central impetus within BRICS — provides India with unusual leverage to mold the financial norms of the future.

The Next Global Playbook: Why the IMF’s Century May Be Ending Sooner Than Expected

This isn’t about one bank replacing another. It’s about the rewriting of financial rules. The IMF wrote the 20th-century playbook; BRICS is scripting the 21st. One is backed by dollars and Western vetoes, the other by people, resources, and an escape from U.S. control.

The question is no longer if BRICS will matter. The question is how soon the West will realize it has already lost control.

FAQs

Q1. Will BRICS replace the IMF?

Not immediately. The IMF has larger resources, but BRICS is creating a strong parallel system that reduces dependency.

Q2. What is de-dollarization?

It is the move to conduct global trade and loans in local currencies instead of U.S. dollars, weakening America’s financial dominance.

Q3. How does India benefit?

India gets NDB loans for infrastructure and energy without austerity conditions, while maintaining influence in both the IMF and BRICS.

FOR MORE BLOGS – beyondthepunchlines.com

Add to favorites

Add to favorites