A clear look at how tax filing, deductions, planning, and digital tools are changing — and what individuals and small businesses need to do to stay accurate, save more, and avoid common mistakes.

Why 2025 Demands a Smarter Approach to Tax Filing — and Why Every Earner Needs to Keep Up

Tax season in India has never been simple — but in 2025, it’s no longer just about filling out forms and hoping for a refund. The rules have changed. The tools have changed. And the expectations placed on every earner — whether salaried, self-employed, investing, studying, or retired — have grown sharper.

This isn’t about fear or complexity. It’s about clarity. Correct filing today is about knowing new regimes, tapping into smarter platforms, and making decisions that actually make a difference in your savings. You might be filing for the first time or optimizing your strategy; this content is designed to keep you informed, confident, and in control.

The Earners Who Need to Be Ready — Because 2025 Isn’t Playing by Old Rules

The tax system no longer caters to just one kind of taxpayer. It’s evolving to reflect how people actually earn — and that means more groups are affected than ever before. Freelancers managing unpredictable income, small business owners juggling growth and compliance, investors tracking gains across platforms, retirees living off interest and pensions, students filing their first return, and salaried professionals navigating regime choices and deductions — all are impacted.

If you earn income in any form, this matters. The sections ahead break down what’s changed, what’s working, and what you can do to stay ahead — with practical insights tailored to your financial reality.

Filing Tips for 2025 — What Each Group Needs to Know

While the rules differ for each type of earner, the goal is the same: file accurately, claim what’s yours, and avoid unnecessary penalties. Here’s what matters most for each group:

Salaried Professionals

- Cross-check Form 16 with AIS and Form 26AS for accuracy

- Claim deductions for HRA, LTA, 80C, and 80D under the old regime

- Consider employer NPS contributions under Section 80CCD(2)

- Use the new regime if deductions are minimal and income is under ₹12 lakh

Freelancers and Independent Contractors

- Use Section 44ADA if eligible for presumptive taxation

- Maintain records of business expenses — software, travel, internet, etc.

- Pay advance tax quarterly to avoid penalties

- Reconcile TDS entries in Form 26AS and AIS

Small Business Owners

- Use Section 44AD for presumptive taxation if turnover is under ₹3 crore

- Separate personal and business expenses for audit clarity

- Automate GST and TDS filings to avoid late fees

- Claim start-up benefits if registered under DPIIT

Investors

- Track capital gains by asset type — equity, debt, real estate, crypto

- Use tax-loss harvesting before March to offset gains

- Match broker statements with AIS and Form 26AS

- Claim TDS on dividends and interest income

Retirees

- Claim the ₹75,000 standard deduction under the new regime

- Deduct medical expenses under Sections 80D and 80DDB

- Use SCSS and PMVVY for stable, tax-efficient returns

- Spread FDs across banks to stay below TDS thresholds

Students and First-Time Filers

- File returns even if not mandatory — it builds your financial record

- Claim education loan interest under Section 80E

- Track freelance income and check for TDS — you might be owed a refund

- Use UPI or bank transfers for proof of income

What You Can Claim in 2025 — Knowing Deductions and Credits That Really Matter

Tax credits and deductions are still the best methods for lowering your tax bill — but they’re frequently misunderstood or underutilized. A deduction lowers your income subject to tax, whereas a credit lowers your tax bill directly. In 2025, various changes have redesigned how they function, making it even crucial to be familiar with your choices.

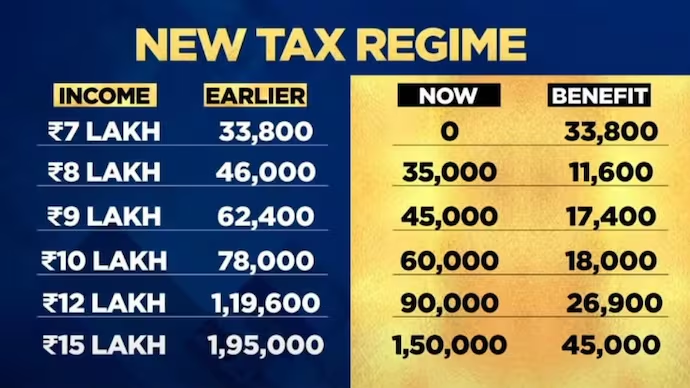

- Standard Deduction Increased: Salaried and retired individuals can now claim ₹75,000 (up from ₹50,000) under the new regime.

- Section 87A Rebate Enhanced: Taxpayers earning up to ₹12 lakh can now become eligible for a complete rebate under the new regime

- Medical Deductions Remain Crucial: Sections 80D and 80DDB continue to offer relief for health insurance and critical illness expenses.

- Education Loan Interest (Section 80E): Still available for students and parents repaying education loans — no upper limit on the amount, but limited to 8 years

- NPS Contributions (Section 80CCD): Employer contributions under 80CCD(2) remain deductible

- Home Loan Interest (Section 24): Deduction of up to ₹2 lakh or more continues as before for self-occupied house property under the old regime

- Start-Up Benefits Extended: Eligible startups registered with DPIIT can still enjoy tax holidays and deductions up to 2030

Planning — Tax Strategies That Work for Various Earners

Tax planning is not merely a matter of filing on time anymore — it’s about making wise, throughout-the-year decisions that minimize your liability and enhance your financial security.

Salaried Professionals

- Optimise salary structure for HRA, LTA, and allowances

- Compare regimes before choosing

- Invest in ELSS, PPF, or NPS under 80C

- Use employer benefits like health insurance and NPS contributions

Freelancers

- Set aside income for advance tax

- Keep digital records of expenses

- Consider a sole proprietorship for better expense management

- Use digital payment platforms for transparency

Small Business Owners

- Register under DPIIT for start-up benefits

- Automate GST and TDS compliance

- Plan capital investments for depreciation benefits

- Schedule quarterly tax reviews

Investors

- Time asset sales for optimal capital gains tax

- Use tax-loss harvesting

- Invest in tax-free bonds or long-term equity

- Keep detailed transaction records

Retirees

- Choose tax-efficient fixed-income instruments

- Claim medical and senior citizen benefits

- Avoid large deposits that trigger TDS

- Spread income sources to stay within rebate limits

Students

- Keep proof of income from internships or freelance work

- Track education loan repayments for 80E claims

- File returns even if below the exemption limit

- Use digital payments for documentation

What’s Still Going Wrong — Common Mistakes to Avoid in 2025

Despite improvement in tools and awareness, several taxpayers still commit avoidable mistakes that result in penalties, foregone refunds, or undue stress. The most frequent among them include relying exclusively on AIS or Form 16 without verification, selecting the incorrect regime without working out, failure to pay advance tax on time, neglecting deductions, not reporting capital gains properly, relying on old software, late filing, neglect of TDS mismatches, and not maintaining digital records of income and expenses.

Filing Smarter — Tax Software That Actually Works in 2025

The proper tax software can make a daunting process run smoothly. In 2025, the top platforms sync up with government sites, monitor deductions in real time, and warn against mistakes before filing.

- Salaried Employees: Auto-import Form 16, reconcile AIS/Form 26AS, and regimes compare

- Freelancers & Businesses: Support for Section 44ADA/44AD, GST filing, expense tracking

- Investors: Capital gains classification, broker sync, crypto reporting

- Retirees & First-Time Filers: Simple interfaces, pre-filled data, clear deduction guidance

- Security & Support: Registered platforms, two-factor authentication, live help

What People Are Saying — Real Testimonials and Authority Insights

“I used to dread tax season, but this year’s software made it surprisingly smooth. It flagged missing deductions I wouldn’t have caught myself.” — Ritika S., Freelance Designer, Pune

“The auto-fill feature saved me hours. I just reviewed and submitted. No errors, no stress.” — Anil M., Retired Banker, Chandigarh

“As a first-time filer, I didn’t know where to start. The platform walked me through everything step by step.” — Karan T., Graduate Intern, Bengaluru

Authority View:

“Digital filing tools are now essential. They reduce manual errors, improve transparency, and help taxpayers stay compliant with evolving rules.” — Central Board of Direct Taxes (CBDT), Annual Compliance Bulletin 2025

What the Future Holds — And Why It’s Time to Wake Up

The tax landscape in India is shifting fast — and it’s not slowing down. With digital compliance becoming the norm, regime choices impacting real savings, and penalties tightening across categories, the future of tax filing will reward those who stay informed, proactive, and precise.

Most earners still treat tax season as a one-time chore. That mindset is outdated. What’s needed now is year-round awareness: tracking expenses, reviewing income sources, choosing the right regime early, and using platforms that simplify the process without compromising accuracy.

The rules aren’t just changing — they’re evolving to demand more from every filer. Salaried, self-employed, investor, or new to it all – now’s the time to prepare. Tax filing in the coming years will be less about fighting deadlines and more about dealing with your money as an ongoing process. Those with good records, who check their position regularly and make informed decisions early on, will not only remain compliant but also save as much as possible.

It’s time to break from the “once-a-year” mindset when it comes to taxes. The future is for earners who:

- Track income and expenses throughout the year

- Compare regimes before the deadline, not on it

- Use digital tools to reduce errors and save time

- Stay updated on policy changes that affect their category

By treating tax planning as a year-round habit rather than a seasonal rush, you’ll be better prepared for whatever changes come next — and you’ll have more control over your financial outcomes.

Tax clarity isn’t optional anymore — it’s your financial edge.

FOR MORE BLOGS – beyondthepunchlines.com

Add to favorites

Add to favorites